It became December 10th, 2017, the day the primary Bitcoin futures become to launch (CBOE) and I like many others had high hopes and turned into waiting for this to have an effect on the charge of Bitcoin positively. After all, Bitcoin already had a top-notch run, maximum of my positions were bought at $2300-$2500 so I was already in brilliant form and could frequently slip away in a daydream planning how I changed into going to spend my tens of millions! Many people back then had charge predictions of $40,000+ for Bitcoin and it became well on its way, however, as all of us quickly located out that wasn’t the case… I will never overlook what came about subsequent, rather than the fee continuing up, it started out to opposite, and $20,000 became, in fact, the pinnacle. The next week there was the most violent swing I have ever seen in my life, the price went from simply over $19k to $10,900 and over that next month turned into the most volatility Bitcoin has ever visible! During this identical time ALL of the investments I had my money in began to fall apart and what appeared like in a single day I had lost $220,000 in my portfolio. I had built my authority in the crypto area by way of that time as a “Youtuber”, I nonetheless keep in mind the live stream I did the morning my largest funding collapsed in on itself and the development group ran. I possibly sounded like such a fool, trying to seem confident at the same time as deep down inner I turned into trembling with fear. The knots in my belly that morning and pretty much every morning after that for a month had been measurable as I felt my future slip away! I misplaced over 10lbs at some stage in that time and changed into constantly sick… It became out that “they” had different plans for Bitcoin and when I say they, it turns out that became the United States authorities and the massive stock marketplace operators worked collectively to stop the Bull Run. CME Groups Leo Melamed stated on November seventh, 2017 “we’ll tame bitcoin”, appears a chunk humorous now to appearance lower back on an announcement like that and realize he actually supposed a month later they were going to suck the existence out of the bull run. Recently ex-CFTC chair Christopher Giancarlo stated that the Trump administration acted to deflate the Bitcoin bubble of 2017 through speedy monitoring the introduction of futures merchandise. I only recognize of two people who known as that top efficaciously, one among them I question if it became a name or now not, and the opposite became a blatant “sell now” name and it turns out that he has 50 years’ experience in markets. Months later, after I shook off the melancholy, I made a plan! See I in no way desired to experience like that ever again and I desired to help others from making that identical mistake! I determined that I had to understand how markets and economics honestly worked, no extra pretending and lying to myself by means of wondering I knew, it became in fact time to move off the deep stop and follow my typical competitive research technique. And boy did I burst off the deep quit, see due to the fact deep down I felt like I was about to examine something that most of the world has no clue approximately and what? I turned into proper! Most humans don’t have any clue how markets ACTUALLY work and the riding pressure to price motion. This exhilaration drove me to long nights falling asleep with books in my hand or handed out drooling on my keyboard. Long in the past, I found out you need to paintings your manner right down to the very middle of a subject, the roots. So I began on the floor with mastering the fundamentals of TA and the extraordinary monetary models (Austrian, Keynesian), then were given lost in what I name “magical indicator

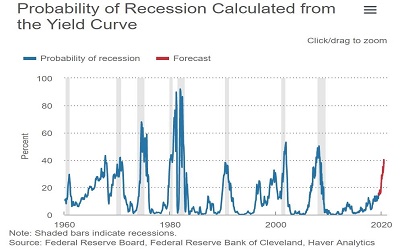

Thank God I didn’t get caught in that for very long. Then I wolfed masses of hours of interviews and books from all of the documented best buyers to ever live! I even dove into hedge fund managers and studied the greats there for a while searching out the patterns, the not unusual tendencies or practices that led to the greatness. I determined something thrilling during that point, those humans barely used signs outdoor of easy-shifting averages, they weren’t seeking out a “magic trade system”, they were based an awful lot in their trades off of expertise all the feasible results (up or down) and what might want to manifest to cause that. From there they formulated their plan, determine how a good deal they have been willing to threaten on the exchange and when they might reduce unfastened on a position. Then they finished! I, in reality, favored this easy technique! See they understood the structure to a market, the cycles those assets might go through and the large factors that drove price action. I look around today and I see very few traders behave this manner, I imply we’re speaking approximately much less than zero. Five% of them take this method. The bulk of investors obtainable are losing and dropping big every zone! Right now we have been seeing steady S&P 500 all-time highs (ATHs) yet the underlying fundamentals of the America economy are displaying a clean signal of slowing down and in reality right now many are forecasting a 2020 recession, the pundits peg us at about a 34% threat currently…

1 Comment